The payment solution for all your B2B online spend: Q-Card App

The Q-Card App, working alongside the Approval App, transforms how businesses handle expenses. It provides virtual payment cards linked to corporate accounts, making it easier to request, approve, and manage expenses. Employees can request funds, which then follow a customizable approval process. When approved, these requests create Q-Cards – secure Mastercards with temporary details.

Is purchased online

75% of tail spend goods are bought through online platforms or multi-seller marketplaces like Amazon Business and eBay Business Supply.

Savings untouched

We see that the ideal tail spend process combined with a correct categorization can already save 5 up to 20% in procure-to-pay costs for indirect materials.

Cost per supplier

The annual cost of vendor data management varies between €100 to €500 per supplier, although the level of data accuracy may still be low.

Safe and controlled

The Q-Card App offers companies the possibility to request one-time credit cards by employees who want to place orders. A virtual credit card with card number, validity date, CVC code and verification code confirmation that can be used worldwide. Anyone can request a card in 2 steps via the app that is pre-approved in the way you have set it up. After approval, the card is active and can be used from a wallet until the validity date. The booking data is immediately registered and automatically processed for accounting. Q-Card is powered by Adyen, the largest payment service provider in Europe and active worldwide.

Save time with pre-coded expenses by cost type, cost center and possibly with associated ledger code and project number. After all, the authorization process is already guaranteed in advance. Problems with corporate cards and monthly statements that require finding out where they come from and how to book them are issues of the past. Employee declarations with retrospective approval can be minimized. Q-Card offers a clear online insight into the status of all payment requests and their processing. The app can also automatically deliver transactions in your accounting system without you having to create and manage al incidental suppliers in your system. You pay minimal transaction costs that are transparent and are charged at the end of the month based on actual use. A big saving compared to a business credit card from your bank. And if something goes wrong? We process your ‘dispute’ with Adyen and you keep track of the settlement and the refund. This also applies to refunds that have been made, but for which the supplier is unable or partially unable to deliver.

Most common challenges:

1. Non-PO spend with one-time vendors

2. High procurement and finance admin costs

3. Maverick spend weighs on bottom-line

4. Uncontrolled and fragmented spending

5. Time-consuming expense management

6. Limited visibility and control over budgets

Want to know more about this app?

Learn about the many different order types we support, and the highly configurable character

Key benefits of

Network Powered Order Collaboration

Be in control

Reduce Vendor Master Data

Closed Loop

Record the payment receipts and VAT percentages in one platform.

Cloud-Based Solution

Store everything in the cloud and never miss important data.

Get real-time visibility

Get full visibility on payment statuses and always know where your money is at.

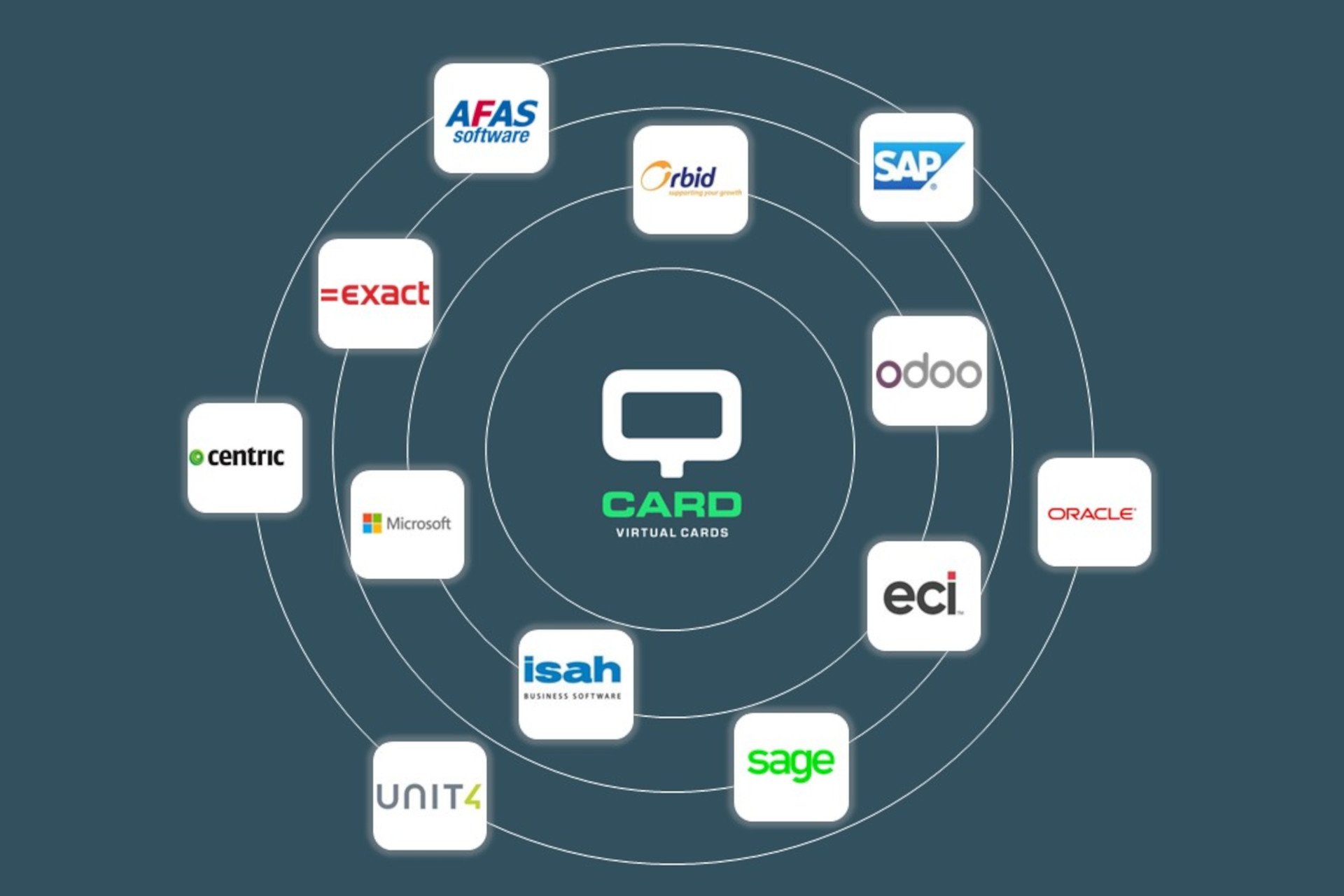

Seamless integration to your ERP system

For Purchasing

Procurement professionals can experience a transformative advantage with our innovative Q-Card app. With full control over expenses, they can alleviate the 'order pressure' and direct their attention towards core purchasing tasks, all while facilitating advance online payments without the need for corporate cards. A unique feature empowers budget owners to take charge of expense management, relieving procurement from the burden. For specialized projects or customer-specific purchases without purchase orders, our solution provides a seamless solution. It also reduces the hassle of vendor data management for rogue spend categories, offers insightful spend analysis within the app, and empowers a self-service model for buyers, streamlining the procurement process like never before.

Q-Card App

Discover the key information you need to make informed decisions. Don't miss out — download the Q-Card factsheet now and equip yourself with the facts that matter!

For Finance

Finance professionals can enjoy a comprehensive suite of benefits with our platform, enhancing financial control and efficiency. They can seamlessly authorize payments in advance while ensuring compliance and segregation of duties, reducing reliance on plastic corporate cards and shared numbers. Customized payments aligned with current cash flows provide financial flexibility. Additionally, our solution streamlines ERP vendor management, focusing only on value-added relationships. It optimizes VAT coding for increased refunds from online spend, offers real-time transaction visibility, and ensures secure settlement and dispute resolution through Adyen. Not only is it much more cost-effective than traditional plastic cards, but it also allows easy card and applicant management via Single Sign-On, making it a valuable tool for finance professionals.

Need more information?

Get insights into how you can improve your order collaboration

Having a good understanding of your current way of working, systems, and issues will allow us to inspire and impress you with the benefits of our supply chain management apps.